TAX DEDUCTION BLUEPRINT!

A must-have for small business owners

ready to save money on taxes & increase

cashflow in a legal, ethical & moral way.

original $999.00

Only $279/one time payment

4.9/5 star reviews

Thousands of happy customers worldwide

Get 90% discount on Tax Deduction Blueprint! Helping business owners save money and increase cash flow this

Black Friday

TAX DEDUCTION BLUEPRINT!

A must-have for small business owners ready to save money on taxes & increase cashflow in a legal, ethical & moral way.

original $499.00

Only $49/one time payment

4.9/5 star reviews

Thousands of happy customers worldwide

READY TO GO ALL IN?

Tax Deduction Blueprint is for you, if you are a...

Start-up Founder that is navigating tax planning for the first time.

Small Business Owner seeking to increase cash flow.

E-Commerce Entrepreneur ready to grow and scale your business.

Gig Worker or Freelancer

Real Estate Investor or Professional building wealth strategically,

THE TAX DEDUCTION BLUEPRINT ADVANTAGE!

Game Changer Benefits of

Tax Deduction Blueprint.

MAXIMIZE YOUR

SAVINGS

Learn proven strategies to uncover hidden deductions and keep more of your hard-earned money.

PRACTICAL AND EASY

TO APPLY

Simple, step-by-step guidance tailored for small business owners, gig workers, and sole proprietors.

UNLOCK THE SECRETS OF BUSINESS DEDUCTIONS

Understand the golden rules of business expenses and how to make them work for you.

COMPREHENSIVE COVERAGE OF KEY TAX STRATEGIES

From home office deductions to the Augusta strategy, discover methods to optimize your tax position.

STAY IRS-COMPLIANT

WITH CONFIDENCE

Master the essentials of tax law to claim deductions legally and confidently.

DESIGNED TO FIT YOUR

BUSY SCHEDULE

Video format allows you to learn at your own pace, with actionable tips you can implement immediately.

NOTE: The insights you gain can lead to thousands in annual tax savings, making this course an investment in your financial future.

Tax Deductions Blueprint is designed for Small & medium sized Business Owners

just like you.

Remove the stress that comes with filing tax returns, eliminate the dread and fear of dealing with the IRS and get the same confidence that high net-worth individuals and the top 1% use to save money, increase cashflow, and grow generational wealth.

(Normally: $999)

Only $499

One time payment

THE TAX DEDUCTION BLUEPRINT ADVANTAGE!

Game Changer Benefits of

Tax Deduction Blueprint?

MAXIMIZE

YOUR SAVINGS

Learn proven strategies to uncover hidden deductions and keep more of your hard-earned money.

PRACTICAL AND EASY

TO APPLY

Simple, step-by-step guidance tailored for small business owners, gig workers, and sole proprietors.

UNLOCK THE SECRETS

OF BUSINESS DEDUCTIONS

Understand the golden rules of business expenses and how to make them work for you.

COMPREHENSIVE COVERAGE

OF KEY TAX STRATEGIES

From home office deductions to the Augusta strategy, discover methods to optimize your tax position.

STAY IRS-COMPLIANT

WITH CONFIDENCE

Master the essentials of tax law to claim deductions legally and confidently.

DESIGNED TO FIT YOUR

BUSY SCHEDULE

Video format allows you to learn at your own pace, with actionable tips you can implement immediately.

Tax Deductions Blueprint is designed for Small medium sized Business Owners just like you,

Remove the stress that comes with filing tax returns, eliminate the dread and fear of dealing with the IRS and get the same confidence our firm uses to help several businesses grow wealth and cashflow.

(Normally: $499)

Black Friday Discount

Only $49

One time payment

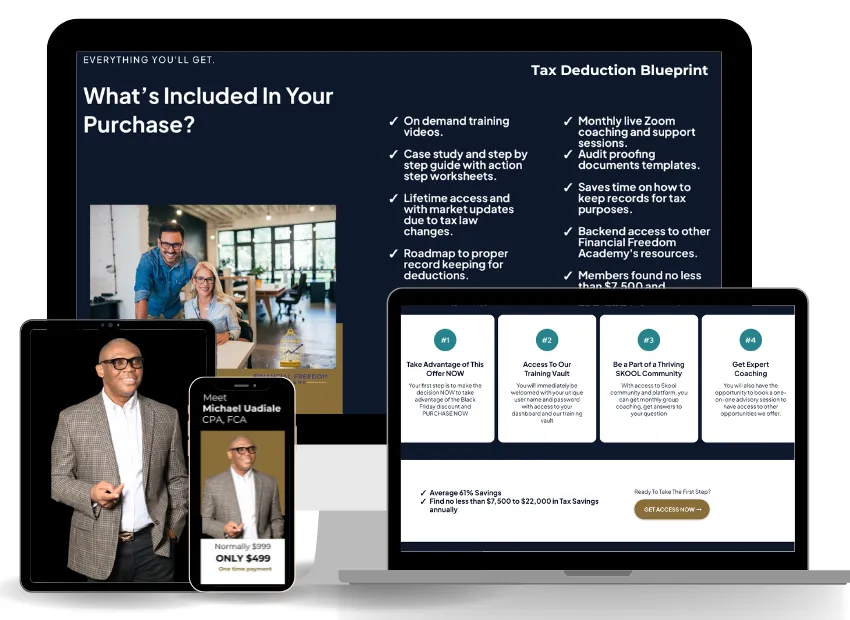

YOUR JOURNEY STARTS NOW!

4 Simple Steps to Save Money & Increase Cashflow...

Take Advantage of This Offer NOW

Your first step is to make the decision NOW and take advantage of this discounted offer.

PURCHASE NOW

Access To Our

Training Vault

You will immediately be welcomed with your unique user name and password with access to your dashboard and our training vault

Be a Part of a Thriving

SKOOL Community

With access to Skool community and platform, you can get monthly group coaching, get answers to your question

Get expert

Coaching

You will also have the opportunity to book a one-on-one advisory session to have access to other opportunities we offer.

Average 61% Savings

Find no less than $7,500 to $22,000 in Tax Savings annually

Ready to take the first step?

take a step!

4 Simple Steps to Tax Deduction Blueprint

Take Advantage

of This Offer NOW

Your first step is to make the decision NOW to take advantage of the Black Friday discount and PURCHASE NOW

Access To Our

Training Vault

You will immediately be welcomed with your unique user name and password with access to your dashboard and our training vault

Be a Part of Thriving

SKOOL Community

With access to Skool community and platform, you can get monthly group coaching, get answers to your question

Get expert

Coaching

You will also have the opportunity to book a one-on-one advisory session to have access to other opportunities we offer.

Average 61% Savings

Find no less than $7,500 to $22,000 in Tax Savings annually

Ready to take the first step?

TESTIMONIALS

real people. real stories.

Success Stories

"I have been using Smeed CPA since 2016 when I bought a house in California. I owned a condo out of state, too, and I knew it was too much for me to do on my own. They've consistently helped me every year since then. They are so thorough and helpful--and they're fast, too."

- Leelah P

"Smeed was great and easy to work with! I called them and the next day they were already going on my taxes. A few days later it was all finished and ready to go. The process was super easy. We uploaded all of our documents online and they contacted us with additional questions. We will definitely use them again!"

- Danielle H.

"Saved our business thousands!! With their knowledge and experience, Smeed is able to take care of all our complicated tax needs. We feel confident in Michael's abilities and he is patient when dealing with our multiple tax questions."

- Rachel C.

"I've been with Smeed for several years and have always received personalized care for my personal and business entities. It's been comforting knowing I have a team to help navigate the complexities of accounting and taxes...my business books have never been this organized and consistent.

Michael is a tax wiz, and it's especially awesome knowing that he's so versed in the tax law and the minute changes that allude a lot of CPAs in my experience."

- Jerome D

"Class act professionals!! We were looking for an accounting firm that could confidently handle our somewhat complicated situation. We couldn't be happier to have found Michael, Karen, and the rest of this wonderful group! During our initial meeting with Michael, he exhibited a depth of knowledge and interest in his field (and beyond!) that immediately put us at ease. The firm has excellent resources at their hands and makes it very easy to interact and communicate. Karen is a pro and easily and quickly completed our taxes. Not only is this group professional, but they are all very warm and friendly!! As extremely happy clients, we HIGHLY recommend them!

- Leelah P

"I have had the opportunity to get to know Michael, owner of Smeed CPA. He came highly recommended by friends who had used him for their business accounting needs. He is a an all round great guy!His company/team are highly professional, passionate and knowledgeable in their field of accounting/CPA. I recently had them assist in my business taxes. I am very happy with their service & results."

- Angela M

real people. real stories.

Success Stories

"I have been using Smeed CPA since 2016 when I bought a house in California. I owned a condo out of state, too, and I knew it was too much for me to do on my own. They've consistently helped me every year since then. They are so thorough and helpful--and they're fast, too."

- Leelah P

"Smeed was great and easy to work with! I called them and the next day they were already going on my taxes. A few days later it was all finished and ready to go. The process was super easy. We uploaded all of our documents online and they contacted us with additional questions. We will definitely use them again!"

- Danielle H.

"Saved our business thousands!! With their knowledge and experience, Smeed is able to take care of all our complicated tax needs. We feel confident in Michael's abilities and he is patient when dealing with our multiple tax questions."

- Rachel C.

"I've been with Smeed for several years and have always received personalized care for my personal and business entities. It's been comforting knowing I have a team to help navigate the complexities of accounting and taxes...my business books have never been this organized and consistent.

Michael is a tax wiz, and it's especially awesome knowing that he's so versed in the tax law and the minute changes that allude a lot of CPAs in my experience."

- Jerome D

"Class act professionals!! We were looking for an accounting firm that could confidently handle our somewhat complicated situation. We couldn't be happier to have found Michael, Karen, and the rest of this wonderful group! During our initial meeting with Michael, he exhibited a depth of knowledge and interest in his field (and beyond!) that immediately put us at ease. The firm has excellent resources at their hands and makes it very easy to interact and communicate. Karen is a pro and easily and quickly completed our taxes. Not only is this group professional, but they are all very warm and friendly!! As extremely happy clients, we HIGHLY recommend them!

- Leelah P

"I have had the opportunity to get to know Michael, owner of Smeed CPA. He came highly recommended by friends who had used him for their business accounting needs. He is a an all round great guy!His company/team are highly professional, passionate and knowledgeable in their field of accounting/CPA. I recently had them assist in my business taxes. I am very happy with their service & results."

- Angela M

our track record!

Our Clients Typically found no less than

$7,500 to $22,000 Savings in TAXES!

our track record!

Our Clients Typically found no less than

$7,500 to $22,000 Savings in TAXES!

Meet

Michael Uadiale

CPA, FCA

Michael Uadiale, CPA, FCA, is the visionary founder and Managing Partner of SMEED CPA, Inc, a recipient of multiple awards for its Tax Advisory Services. With a passion for entrepreneurship, Michael has dedicated his career to simplifying the labyrinth of tax codes, empowering business owners to legally reduce their tax burdens, and amass wealth.

As a licensed Certified Public Accountant with national Practice, he is licensed in the States of California and Texas. Michael's expertise is rooted in his ability to translate complex tax jargon into actionable strategies. His Financial Freedom Academy serves as the compass for numerous high-net-worth entrepreneurs, benefiting from his wealth of knowledge and mentorship.

Join Michael on a transformative journey to tax efficiency and financial prosperity. Subscribe to his online video course today and uncover the secrets to legally, ethically and morally reducing your taxes and building lasting wealth."

Meet

Michael Uadiale

CPA, FCA

Michael Uadiale, CPA, FCA, is the visionary founder and Managing Partner of SMEED CPA, Inc, a recipient of multiple awards for its Tax Advisory Services. With a passion for entrepreneurship, Michael has dedicated his career to simplifying the labyrinth of tax codes, empowering business owners to legally reduce their tax burdens, and amass wealth.

As a licensed Certified Public Accountant with national Practice, he is licensed in the States of California and Texas. Michael's expertise is rooted in his ability to translate complex tax jargon into actionable strategies. His Financial Freedom Academy serves as the compass for numerous high-net-worth entrepreneurs, benefiting from his wealth of knowledge and mentorship.

Join Michael on a transformative journey to tax efficiency and financial prosperity. Subscribe to his online video course today and uncover the secrets to legally, ethically and morally reducing your taxes and building lasting wealth."

INSIDE THE COURSE,

YOU'LL LEARN:

1. B.O.N.D. GOLDEN RULES OF SECTION 162

Unlock the core of business expense deductions with

this essential part of the tax code.

Learn theB.O.N.D. Golden Rule of Deductions—Business, Ordinary, Necessary, Documented—to master tax-deductible expenses.

Discover how 97% of the tax code is designed to incentivize entrepreneurs and investors and how to use it to your advantage.

Master theBusiness, Ordinary, and Necessary Tests to align expenses with industry norms and ensure they are justifiable.

Explore the Document Test and the 4Ps of Documentation (Price, People, Place, Purpose) for bulletproof record keeping.

Gain actionable strategies to maximize deductions, minimize audit risks, and turn the tax code into a strategic tool for business growth.

Shift from reactive to proactive tax planning with practical examples and insights tailored to small business owners and entrepreneurs.

Build confidence in optimizing deductions while staying compliant with IRS regulations.

2. HOME OFFICE - THE GIFT THAT KEEPS GIVING

How to maximize an often-overlooked deduction and save big.

Learn how to qualify for the home office deduction with clear rules like exclusivity, regular use, and administrative use, tailored to different business types.

Understand how to categorize qualifying expenses (100% deductible, partially deductible, or non-deductible) and apply methods like the Net Square Footage Method for maximum savings.

Discover the benefits of a home office in enhancing travel deductions and auto expense deductions by eliminating "commuting" costs.

Explore strategies for employing minor children in your home office, reducing family tax liability while building legitimate deductions.

Leverage the home office deduction to optimize deductions for sole proprietors, partnerships, and corporations through accountable plans and accurate reporting.

Learn audit-proofing techniques, including proactive documentation, compliance with IRS guidelines, and creating a defensible deduction strategy.

Maximize your home office’s tax advantages while staying compliant with IRS regulations

3. THE AUGUSTA STRATEGY

Discover a powerful yet legal way to rent your

home to your business tax-free.

Discover how to legally rent your home to your business for up to14 tax-free days per year, reducing business taxable income while earning tax-free personal income.

Learn the eligibility criteria, including which business structures can use this strategy (corporations, partnerships, LLCs) and why sole proprietors are excluded.

Understand the difference between the Augusta Strategy and the Home Office deduction and how to use them together for maximum tax benefits.

Follow a step-by-step implementation guide, including setting fair rental rates, creating lease agreements, documenting meetings, and issuing 1099 forms for audit compliance.

Maximize tax savings with detailed insights into fair rental value calculation and audit-proofing techniques using templates and documentation tools.

Realize dual benefits: reduced business taxes and increased tax-free personal cash flow.

Equip yourself with tools and strategies to ensure compliance and successfully defend this powerful tax-saving strategy during an audit.

4. AUTO EXPENSE DEDUCTION

Track and claim vehicle expenses with

ease, whether you lease or own. "Making Travels 100% Deductible"

Learn the criteria for deductibility of business travel expenses, including the 51/49 rule for domestic and the 75% rule for overseas travel.

Master the five types of travel days (e.g., Work Day, Sandwich Day) to maximize deductions for transportation, lodging, and meals.

Explore tax rules for special travel scenarios, such as cruises and international trips, including pro rata calculations for mixed business and personal trips.

Discover how to deduct transportation costs, from flights to private vehicles, while ensuring compliance with IRS documentation requirements.

Leverage strategies like the Saturday Night Stay Rule to lower travel costs and increase deductibility.

Access tools and templates for audit-proofing travel expenses, including tax journals and detailed receipt tracking.

Maximize savings by properly documenting the business purpose, location, and cost of all travel-related expenses.

5. DRIVE HAPPY WITH AUTO DEDUCTION

Maximize deductions for client meetings, team

lunches, and business-related dining.

Understand the two main methods for deducting auto expenses: Standard Mileage Rate and Actual Expense Method, and learn to choose the most advantageous option.

Discover tax strategies for leasing vs. buying a vehicle, including depreciation benefits and cash flow considerations. Learn to maximize deductions by properly tracking business usage, maintaining detailed records, and leveraging overlooked deductions like interest on vehicle loans.

Explore advanced tax tips like using multiple vehicles for business, assigning vehicles to avoid SALT caps, and strategies for vehicle sales.

Determine eligibility for deduction methods, with insights on rules for leased vehicles, depreciation, and business fleets.

Audit-proof your auto deductions with meticulous mileage logs, linked business calendars, and effective sampling techniques for accurate record-keeping.

Gain tools and strategies to ensure compliance while maximizing cash savings from your vehicle’s business use.

6. BUSINESS MEALS

Maximize deductions for client meetings,

team lunches, and business-related dining.

Learn the qualification criteria for business meal deductions, including meeting the "ordinary and necessary" and "not lavish or extravagant" tests.

Understand the 50% deduction rule and its application to meals with clients, employees, or business associates.

Master the presence test to ensure the taxpayer or an employee must be present at the meal for the expense to qualify.

Separate meals from entertainment costs for compliance, as entertainment expenses are non-deductible under current tax law.

Discover practical tips for audit-proofing meal deductions, such as maintaining detailed receipts, noting business purposes, and documenting participants.

Ensure compliance by keeping clear records even for small transactions and learning to distinguish meal expenses from bundled entertainment costs.

Apply these strategies to maximize deductions while adhering to IRS regulations for business-related meals.

7. EDUCATION EXPENSES

Turn professional development costs into tax savings.

Learn how to deduct job-related education expenses for yourself, employees, and even your children, ensuring they meet IRS criteria for compliance.

Explore the rules for undergraduate and MBA programs, understanding when these expenses qualify as job-related and how to document them for tax purposes.

Take advantage of Section 127 Education Plans, allowing employers to provide up to $5,250 per year in tax-free education benefits to employees.

Understand exceptions and restrictions, such as ensuring educational benefits don’t qualify employees for a new profession, and eligibility criteria for using Section 127 for family members.

Discover audit-proofing techniques, like aligning education expenses with job duties and maintaining thorough documentation to substantiate deductions.

Leverage these strategies to provide valuable educational support while maximizing tax deductions for your business.

8. BUSINESS MEDICAL PLANS

Leverage health reimbursement accounts and medical

plan strategies to save on taxes while staying healthy.

Explore strategies for deducting medical expenses, from health insurance for S Corporation owners to Section 105-HRA plans for small businesses and sole proprietors.

Learn how to implement Section 105-HRA plans, allowing business owners to deduct medical expenses for their family while adhering to IRS rules.

Understand the benefits of QSEHRA and ICHRA plans, providing small businesses with flexible, tax-efficient alternatives to traditional group health plans.

Maximize tax savings with Health Savings Accounts (HSAs), leveraging pre-tax contributions, tax-free growth, and portability for long-term medical expenses.

Navigate the complexities of deducting self-employed health insurance and comply with reporting rules for S Corporation health benefits to avoid audit risks.

Recognize the limitations of certain options like Health Care Sharing Ministries, which are not tax-deductible under IRS rules.

Gain insights into compliance and documentation to optimize deductions and ensure your medical expense strategy aligns with tax regulations.

9. EXPENSE PREPAYMENT

Leverage health reimbursement accounts and medical

plan strategies to save on taxes while staying healthy.

Learn how prepaying eligible expenses can lower taxable income by taking deductions in the year the payment is made, not when the expense is incurred.

Understand the 12-Month Safe Harbor Rule, which permits deductions for prepaid expenses that benefit the business within 12 months or by the end of the next tax year.

Explore practical examples, such as prepaying malpractice insurance or office rent, while avoiding disallowed prepayments like loan interest or capital assets.

Discover how this strategy can help manage tax brackets, especially in years with higher-than-usual income, by strategically reducing taxable income.

Use expense prepayments to optimize the Section 199A QBI deduction, ensuring high-income professionals stay below income thresholds to maximize the 20% pass-through deduction.

Gain clarity on IRS-approved methods and prohibited expenses, ensuring compliance while leveraging prepayments effectively.

Benefit from actionable tips for integrating prepayments into your broader tax plan to reduce liabilities and enhance cash flow.

10. ACCOUNTABLE PLANS

Optimize reimbursements for you and your

team while keeping the IRS happy.

Introduction to Accountable plan.

Five Rules of the Accountable plan that can help you save Taxes in real time.

How to recognize typical eligible expenses.

Learn the eligible entities for accountable plans

ALSO GET FREE ACCESS TO OUR SKOOL COMMUNITY

JOIN US @ SKOOL

Get there faster with personal mentorship by Michael Uadiale,CPA.

With Financial Freedom Academy now on Skool platform, with this special Black Friday purchase. you will also have FREE membership to our Skool community for 12 months.

Overcome the fear of doing it alone and accelerate your goal of saving money on taxes and increasing cash-flow for your business.

original $999.00

Only $499/one time payment

ALSO GET FREE ACCESS TO OUR SKOOL COMMUNITY

JOIN US @ SKOOL

Get there faster with personal mentorship by Michael Uadiale,CPA.

With Financial Freedom Academy now on Skool platform, with this special Black Friday purchase. you will also have FREE membership to our Skool community for 12 months.

Overcome the fear of doing it alone and accelerate your goal of saving money on taxes and increasing cash-flow for your business.

original $499.00/monthly

Only $49/one time

(black Friday discount)

STILL GOT QUESTIONS?

Frequently Asked Questions

Can I Cancel anytime?

The membership for the Skool platform access and community is free and you can cancel at anytime. The purchase for the Tax Deduction Blueprint is discounted significantly and it is therefore final. However feel free to email us at [email protected] for any concern after your purchase

How do I know this is for me?

Absolutely—if you're looking to maximize your tax savings, this course is a game-changer!

Whether you're a:

Start-up Founder that is navigating tax planning for the first time.

Small Business Owner seeking to increase cash flow.

E-Commerce Entrepreneur ready to grow and scale your business.

Gig Worker or Freelancer

Real Estate Investor or Professional building wealth strategically,

What if I don't have a business yet?

No problem! This course is also perfect for future business owners. If you’re planning to start a business or side hustle, you’ll learn the essential tax strategies to hit the ground running. By knowing how to structure your business, track expenses, and claim deductions from day one, you’ll save money and avoid costly mistakes before you even launch!

What topics do you cover?

This course dives deep into the tax strategies that savvy business owners and professionals use to save thousands every year. Here’s what you’ll master:

The Golden Rules of Section 162: Unlock the core of business expense deductions with this essential part of the tax code.

Home Office – The Gift That Keeps Giving: Learn how to maximize this often-overlooked deduction and save big.

The Augusta Strategy: Discover a powerful yet legal way to rent your home to your business tax-free.

Auto Expense Deduction: Track and claim vehicle expenses with ease, whether you lease or own.

Business Meals: Maximize deductions for client meetings, team lunches, and business-related dining.

Education Expenses: Turn professional development costs into tax savings.

Business Medical Plans: Leverage health reimbursement accounts and medical plan strategies to save on taxes while staying healthy.

Expense Prepayment: Learn how to legally prepay expenses to reduce your taxable income.

Accountable Plan: Optimize reimbursements for you and your team while keeping the IRS happy.

By the end of this course, you’ll know how to take full advantage of these strategies, helping you keep more of your hard-earned money!

What networking opportunity is available to me?

Our Skool community offers you the chance to connect with like-minded small business owners and subject matter experts. It’s a supportive space to share ideas, ask questions, and build valuable relationships. While collaborating or doing business with others is entirely up to you, the connections you’ll make here could open doors to exciting opportunities!

Is there is a catch I should be aware of ?

No catch—just straightforward value! For a one-time payment of $49, you’ll gain lifetime access to this entire course library. Plus, you’ll get free access to our Skool community, where you can connect with like-minded professionals. If you’re interested in expanding your knowledge, additional courses will be available for purchase as they’re released. And to top it off, you can book a free advisory session with one of our team members. No hidden fees, no strings attached—just a smart investment in your financial future!

Can I get money back guarantee

We’ve priced this course at an unbeatable value and included free access to our Skool platform as an added bonus. Because of this, we don’t offer refunds or money-back guarantees. However, your satisfaction is important to us! If you feel the course didn’t deliver the value you expected, please reach out to us at [email protected], and we’ll work with you to make it right.

Everything you'll get.

What’s included in your purchase?

On demand training videos.

Case study and step by step guide with action step worksheets.

Lifetime access and with market updates due to tax law changes.

Roadmap to proper record keeping for deductions.

A like minded community with opportunity to network.

TBD can help you remove the stress that comes with filing tax returns.

Monthly live Zoom coaching and support sessions.

Audit proofing documents templates.

Saves time on how to keep records for tax purposes.

Backend access to other Financial Freedom Academy's resources.

Our Clients typically found no less than

$7,500 to $22,000 savings in taxes!

TBD make filing of accurate and complete tax returns easy.

get started today

Are you ready to unlock your business potential?

Save money, and eliminate

dread of dealing with the IRS.

Enter you info below to get started

(Normally: $999)

Only $499

One time payment

Everything you'll get.

What’s included in your purchase?

On demand training videos.

Case study and step by step guide with action step worksheets.

Lifetime access and with market updates due to tax law changes.

Roadmap to proper record keeping for deductions.

A like minded community with opportunity to network.

TBD can help you remove the stress that comes with filing tax returns.

Monthly live Zoom coaching and support sessions.

Audit proofing documents templates.

Saves time on how to keep records for tax purposes.

Backend access to other Financial Freedom Academy's resources.

Members found no less than $7,500 and probably $15,000 to $50,000 in tax savings annually.

TBD make filing of accurate and complete tax returns easy.

get started today

Are you ready to unlock your business potential?

Save money, and eliminate

dread of dealing with the IRS.

Enter you info below to get started

(Normally: $499)

Only $49

One time payment/BLACK FRIDAY SPECIAL

STILL NOT SURE?

Satisfaction Guaranteed

We guarantee that you are no longer going to be alone.

As a small business owner, you are leaving a lot on the table from lack of education

or lack of knowledge of the complicated tax systems, designed to help you save money

and increase capital for your business. Tax Deduction Blueprint will educate you and provide

clear pathways for you to achieve your ultimate goal of thriving in business.

With our Skool community, you have access to subject matter experts, coaching, and growth

tools. Sky is no longer your limit!

STILL NOT SURE?

Satisfaction Guaranteed

We guarantee that you are no longer going to be alone. As a small business owner, you are leaving a lot on the table from lack of education or lack of knowledge of the complicated tax systems, designed to help you save money and increase capital for your business. Tax Deduction Blueprint will educate you and provide clear pathways for you to achieve your ultimate goal of thriving in business. With our Skool community, you have access to subject matter experts, coaching, and growth tools. Sky is no longer your limit!

Limited Time Offer!

Cash Flow & Grow Your Business

Copyright © FINANCIAL FREEDOM ACADEMY

2024 | Terms & Condition | Disclosure